Finance

The US federal budget reaches a grim milestone as interest payments overtake defense spending

The United States has long had the the largest defense budget in the worldwith spending expected to approach $900 billion this year.

Yet these expenses are quickly being eclipsed by the fastest-growing part of the federal outflow: interest payments on the national debt.

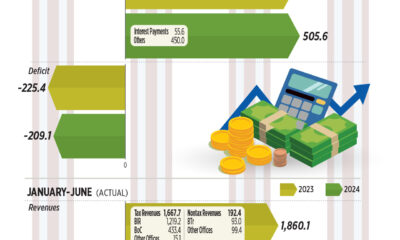

For the first seven months of fiscal year 2024Net interest payments, which started last October, totaled $514 billion, surpassing defense by $20 billion. Budget analysts I think that trend will continuemaking 2024 the first year ever in which the United States will spend more on interest payments than on national defense.

Just now two years agointerest payments were the seventh largest federal spending categorybehind Social Security, health programs other than Medicare, income support, national defense, Medicare, and education.

Interest is now the third largest expense, after Social Security and Medicare. And not because any of the other programs are shrinking. While most government expenditures grow modestly from year to year, interest costs will be 41% higher in 2024 than in 2023.

Interest payments are increasing for two obvious reasons.

The first is that annual deficits have explodedleaving the nation with one a massive federal debt of $34.6 trillion156% higher than the national debt at the end of 2010.

In the 1990s, the average federal deficit was $138 billion per year. In the 2000s this amounted to $318 billion. In the 2010s this amounted to $829 billion. Since 2020, the annual deficit has increased to $2.24 trillion, largely due to pandemic-related stimulus measures in 2020 and 2021. projection for 2024 There is a $1.5 trillion deficit.

As a percentage of GDP, the annual deficit has almost doubled in just ten years, from 2.8% in 2014 to an expected 5.3% in 2024. So there are simply many more loans to pay interest on.

The government is also paying more to borrow because interest rates have risen over the past two years. Like consumers buying houses and cars, Uncle Sam benefits from cheap money when interest rates are low, and carries a heavier burden when interest rates are high.

From 2010 to 2021, the average interest rate on all government bonds sold to the public was just 2.1%, keeping overall interest payments manageable.

But in 2022, the Federal Reserve began raising rates to curb inflation, and the government now pays an average interest rate of 3.3%. So the amount of money borrowed continues to rise, and the cost of borrowing that money also rises.

If more taxpayer money goes to interest charges, there will eventually be less money left for everything else, and at some point the Treasury will no longer be able to borrow from the problem.

It is an unsustainable situation, which could lead to investors losing confidence in the government’s creditworthiness and demanding even higher interest rates to buy government bonds.

Give Rick Newman a note, follow him on Twitteror sign up for his newsletter.

However, the urgency of the problem is up for debate.

At the recent Milken Institute conference in Los Angeles, luminaries such as billionaire investor Ken Griffin and former House Speaker Paul Ryan warned of a looming debt crisis if government interest costs continue to rise. But many leading financiers also touted the United States as the world’s best destination for investment, despite all its problems.

And many predictions of a debt crisis when interest costs were much lower have so far proven to be incorrect.

Two people who are not bothered by the American debt burden are President Joe Biden and former President Donald Trump, the two main candidates in this year’s race for the White House. He is also not making reducing the budget deficit a spearhead of his presidential campaign.

Biden does indeed have a plan of sorts. He would increase taxes on corporations and the wealthy and use some of that revenue to reduce annual deficits. But Biden also wants to spend more on social programs, which could offset any cuts.

Trump says he would encourage more oil and natural gas drilling, which would somehow generate a windfall in tax revenue that would pay off the debt. But there is no obvious way that would happenregardless of how much drilling is done.

Moreover, both men have presided over a massive increase in the national debt.

The national debt rose by $7.8 trillion during Trump’s four years as president and by $6.8 trillion during Biden’s first three years and four months.

Earlier this year, the Committee for a Responsible Federal Budget helped Yahoo Finance analyze who is responsible for the national debt. The blame lies more or less equally with the governments of both parties who borrow to finance wars, tax cuts, spending programs and stimulus measures. recessions.

When the time comes to pay down the debt, the inevitable solution will be a mix of spending cuts and tax increases, which will make many people unhappy.

That reveals the real reason why no politician wants to address the problem: everyone hopes it will be the man behind them.

Rick Newman is a senior columnist for Yahoo Finance. Follow him on Twitter at @rickjnewman.

Click here for political news on the business and money policies that will determine tomorrow’s stock prices.

Read the latest financial and business news from Yahoo Finance