Finance

Better Artificial Intelligence Stocks: Nvidia vs. Arm Holdings

Building wealth can take decades, or if you own it Nvidia (NASDAQ: NVDA), it may take about a year. Over the past year, the stock has risen a remarkable 165% due to accelerated growth associated with heavy investments in artificial intelligence (AI) in the technology space.

But it’s not the only one generating huge investment returns. Arm positions (NASDAQ:ARM) is no slouch either; shares are up more than 120%. That leaves investors with an excellent dilemma: which AI stock is the best to own?

It turns out that one is much more likely to continue its run than the other. Which? Here’s what you need to know.

Both companies play a crucial role in AI

The strong momentum behind both stocks underlines the key role of each company in this AI. It’s unclear what that technology will look like in five or ten years, but chances are Nvidia and Arm Holdings will be in the middle of it.

Nvidia’s AI chips have more or less become the building blocks of AI technology. AI language models like ChatGPT train on massive data centers with thousands of chips.

Nvidia chips are specialized in demanding applications with high computing power. These features are perfect for AI, and the company has done a great job optimizing its chips and software for it.

Companies investing to build these AI models have all gravitated toward Nvidia, giving the company an estimated 90% market share for AI chips. It is unclear when (or if) it will lose its stranglehold on the chip market.

Arm Holdings is perhaps the gold standard for computer chip design. The central processing unit (CPU) architecture is the basis for approximately half of the world’s computer chips. That footprint includes smartphones, vehicles, computers and more.

Arm makes money by charging royalties and licensing fees for every chip that uses its intellectual property. That includes Nvidia’s next-generation Grace series data center CPUs.

Both Nvidia and Arm Holdings will likely have a big say in the future of AI.

Both companies are already benefiting from AI

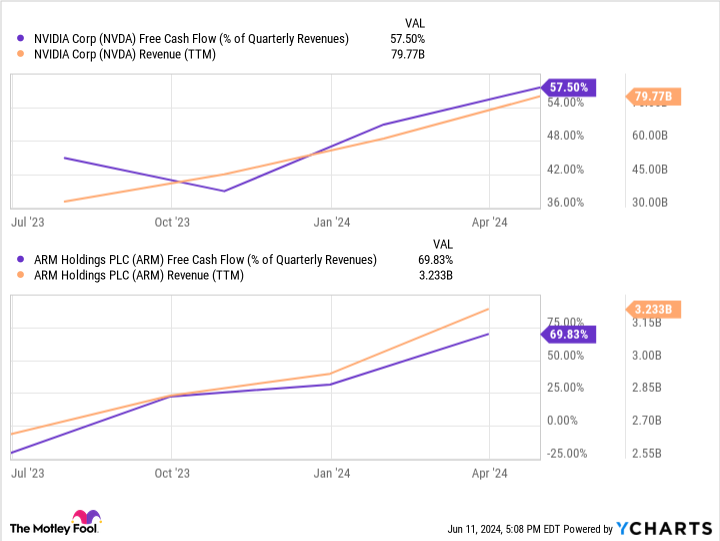

Both companies are already seeing the impact of AI on their business. Nvidia and Arm are highly profitable, and accelerated revenue growth fills each company’s coffers:

Arm’s operations have proven to be more profitable; The company’s main costs are research and development. About $0.70 of every dollar of sales ends up as free cash flow. But Arm is a much smaller company than Nvidia. Last twelve months revenue is just over $3.2 billion.

Meanwhile, Nvidia isn’t as efficient as Arm at turning sales into cash flow, but it does generate profits much more revenue: almost $80 billion last year.

Nvidia’s ability to sell a physical product at such high margins is impressive, which is why it will generate much more cash flow than Arm in the long run. More cash flow gives a company more options. Nvidia even came close to acquiring Arm Holdings before the company went public, but the merger fell through. Give Nvidia the edge here because of its comparable profitability at a much larger size.

The gap widens when it comes to appreciation

Analysts are equally optimistic about both companies’ earnings growth in the coming years. Consensus long-term estimates call for around 31% annualized earnings growth for both Nvidia and Arm. However, below you can see that the starting rating for each is dramatically different:

With a price-to-earnings (P/E) ratio half that of Arm Holdings, Nvidia stock has a built-in margin of safety. Assuming the growth estimates prove accurate, Nvidia is much more likely to outperform.

As they say, the higher they go, the further they can fall. High ratings leave less room for things to go wrong. Arm Holdings could be performing exceptionally well as a company, and something – even something outside the company, like broader market volatility – could send the stock down.

Nvidia and Arm Holdings are blue chip tech stocks with a bright future in AI due to their exceptional competitive position. However, given the dramatic difference in valuation, Nvidia seems like the better AI stock to buy today.

Should You Invest $1,000 in Nvidia Now?

Consider the following before buying shares in Nvidia:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $794,196!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns June 10, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has one disclosure policy.

Better Artificial Intelligence Stocks: Nvidia vs. Arm Holdings was originally published by The Motley Fool