Finance

Nvidia shares rise after big earnings beat and announcement of 10-for-1 stock split

-

Nvidia shares rose as much as 5% after it reported first-quarter earnings results on Wednesday.

-

The company exceeded earnings and revenue expectations thanks to the continued strength of its GPU business.

-

Nvidia increased its dividend and announced a 10-for-1 stock split.

Nvidia The stock rose to record highs in after-hours trading on Wednesday after the company reported this profit figures for the first quarter.

The chipmaker’s shares rose as much as 5% to about $993 per share after the earnings release. The company reported a 262% year-over-year revenue increase, driven by the continued success of its AI-enabled GPU chips, primarily the H100.

These were the most important figures:

-

Gain: $26.04 billion, compared to analyst estimates of $24.65 billion

-

Data center revenues: $22.6 billion, representing a 427% increase from the same quarter last year

-

Adjusted earnings per share: $6.12, compared to analyst estimates of $5.59

Nvidia also offered solid second-quarter revenue guidance of $28 billion versus analyst estimates of $26.61 billion, indicating the company expects continued strong sales even as customers await its next-generation GPU chip, Blackwell, which will arrive in the second will be released half of this year. the year.

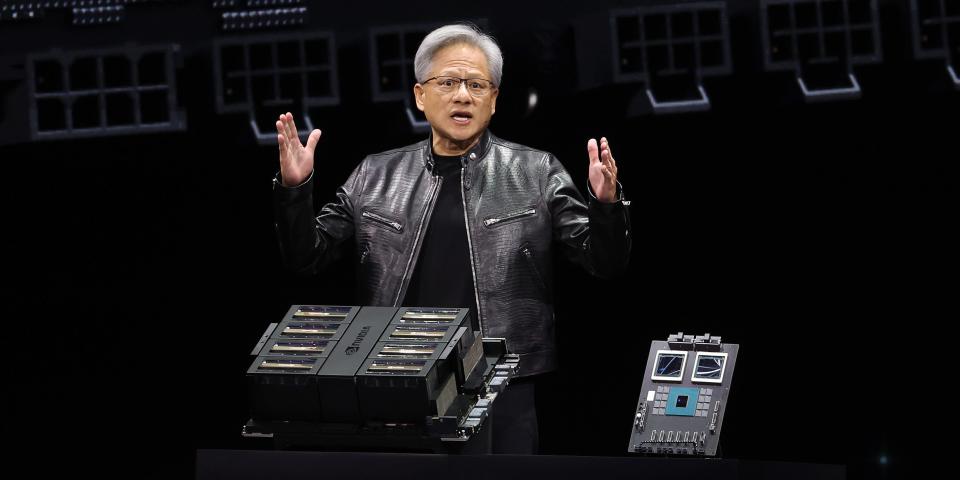

“We are ready for our next wave of growth. The Blackwell platform is in full production and provides the foundation for generative AI on trillions of parameters,” said Nvidia CEO Jensen Huang.

The company announced a 10-for-1 stock split next month. It also increased its quarterly dividend by 150% from $0.04 to $0.10 per share.

Analysts will eagerly await Huang’s comments on the company’s conference call, looking for possible directions on where he sees the AI chip market going for the rest of the year and beyond.

“Even against enormous expectations, the company once again delivered and delivered. The ever-important data center revenue was strong, while future revenue was also impressive. In short, the bar was high and the bar was raised again,” says Carson Group. said Ryan Detrick.

Read the original article Business insider