Business

The Philippines’ balance of payments deficit is widening

The country’s balance of payments (BoP) deficit widened in April as the government repaid foreign debt and the trade balance remained low.FThis is what the Bangko Sentral ng Pilipinas (BSP) said.

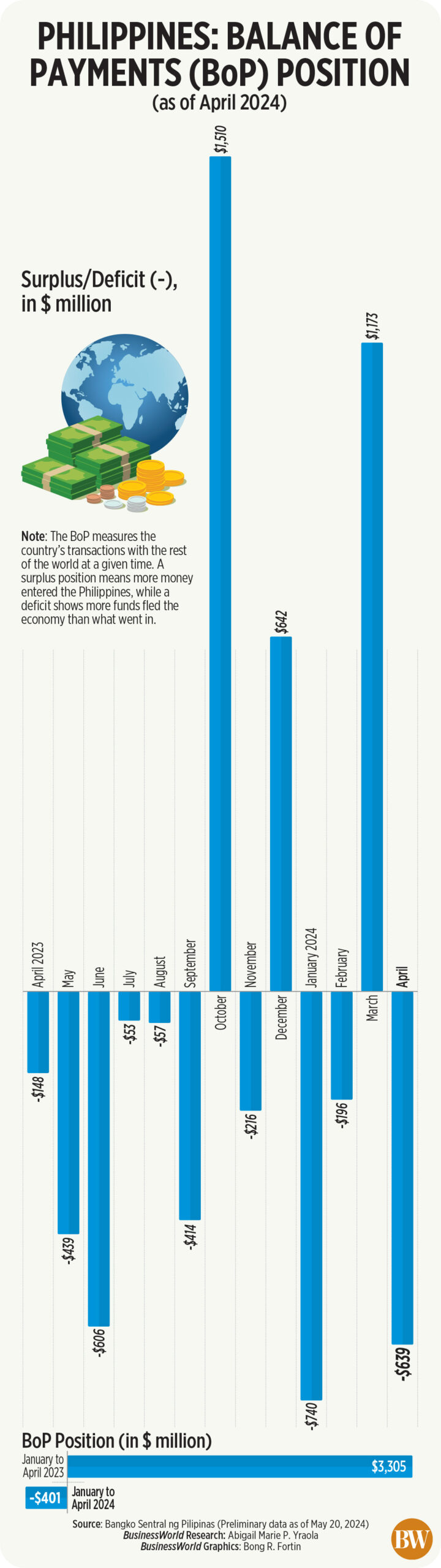

Central bank data shows the BoP position increased to $639 millionFIn April, there was a deficit of $148 million a year ago.

This was also a reversal from the $1.17 billion surplus recorded in March.

The BoP measures a country’s transactions with the rest of the world at a given point in time. One theFicit means that more money left the economy than came in, while a surplus shows that more money came into the Philippines.

“The BoP theFicit in April 2024 reFexquisiteFlows mainly arising from net withdrawals of foreign currency by the National Government (NG) from its deposits with the BSP to service its foreign currency debt and pay its various expenses,” the central bank said in a statement.

In the FIn the first four months, the BoP position swung to a deficit of $401 million, compared to the surplus of $3.3 billion a year ago.

“Based on preliminary data, this cumulative BoP deficit mainly reflected the NG’s repayments of its foreign loans, coupled with continued trade in goods.Ficit,” it added.

The trade theFThe ICIT fell sharply from $5.02 billion to $3.18 billion in MarchFIT a year ago. In the Ffirst quarter, trading theFicit shrank 22.2% year on year to $11.24 billion.

Michael L. Ricafort, chief economist of Rizal Commercial Banking Corp., said the BoP deficit was due to the payment of foreign obligations. This included the scheduled repayment of $365 million in mature Japanese yen bonds on April 12.

In the first quarter, debt repayments rose 74% to P986.036 billion. These include the P93.37 billion in foreign debt payments and P54.11 billion in interest payments on the foreign debts.

At the end of April the BoP was reFread one FThe final gross international reserve (GIR) level is $102.6 billion, down 1.4% from $104.1 billion at the end of March.

The dollar reserves were sufficient to cover 5.8 times the country’s short-term foreign debt based on the original maturity and 3.6 times based on the remaining maturity.

It also corresponds to 7.6 months of imports of goods and payments for services and primary income.

An ample level of foreign exchange buFFers protects an economy from market volatility and is a guarantee of the country’s ability to pay off debts in the event of an economic downturn.

For the In the coming months, Mr. Ricafort said the BoP’s position could improve “partly thanks to proceeds from the national government’s foreign currency-denominated loans that would also be added to the country’s BoP and GIR, as well as from official development assistance and other multilateral sources. ”

In May, the government raised $2 billion from issuing double-tranche dollar bonds with 10- and 25-year maturities. This was the first global bond sale in the Philippines this year.

Mr Ricafort also noted that continued growth in remittances, business process outsourcing (BPO) revenues, foreign tourism revenues and foreign direct investment would help support the BoP’s position.

This year, the BSP expects the country’s BoP position to end up with a deficit of $700 million, equivalent to 0.1% of GDP. — Luisa Maria Jacinta C. Jocson